ROUNDUP: How the Gas Tax Suspension Actually Affects Virginians

On Wednesday, March 16th, Governor Youngkin announced his plan to propose emergency legislation during the upcoming special session to suspend the state gas tax for three months, pending General Assembly approval. The state gas tax is currently 26 cents per gallon. Youngkin said this will replace his previous proposal in the House budget, which would have suspended the most recent 5 cent-per-gallon gas tax increase for 12 months effective July 1.

The fact of the matter is that a gas tax suspension won’t actually lower gas prices or help Virginians save money. Instead, a gas tax suspension will drastically cut public transit and rail funding – services Virginians need now more than ever. The suspension will hit lower-income Virginians the hardest, who often lack access to a car and more often utilize the public transit that will be directly impacted by this proposed suspension.

Gas tax savings are pocketed by oil companies, not consumers.

The state gas tax doesn’t make gas expensive – profiteering by oil and gas CEOs does. Right now, oil and gas companies are taking advantage of the chaos from Putin’s invasion of Ukraine, which has driven demand high while supply is low. Oil and gas companies know that they can price gouge gas by charging consumers through the roof due to the unpredictable global market.

According to a polling report, “we will continue to experience big spikes in gas prices as long as we are dependent on oil, because oil supplies are unreliable, dictators like Vladimir Putin and countries like Saudi Arabia use oil as a political weapon, and oil company CEOs are focused on maximizing their profits.” The global gas market, and local gas prices, will not be solved by state-level policy, proven by failed gas tax suspensions by other states.

Maryland’s gas tax holiday is already failing to help residents save money.

Gas tax suspensions in other states have historically not lowered the price of gas. Maryland’s recent gas tax break policy has demonstrated that oil and gas companies are indeed eating up consumers’ intended savings. Since the Maryland gas tax suspension started, oil companies have profited about $8 million in gas tax savings meant for Maryland citizens, while the average Maryland driver has saved barely $5 from the gas tax suspension.

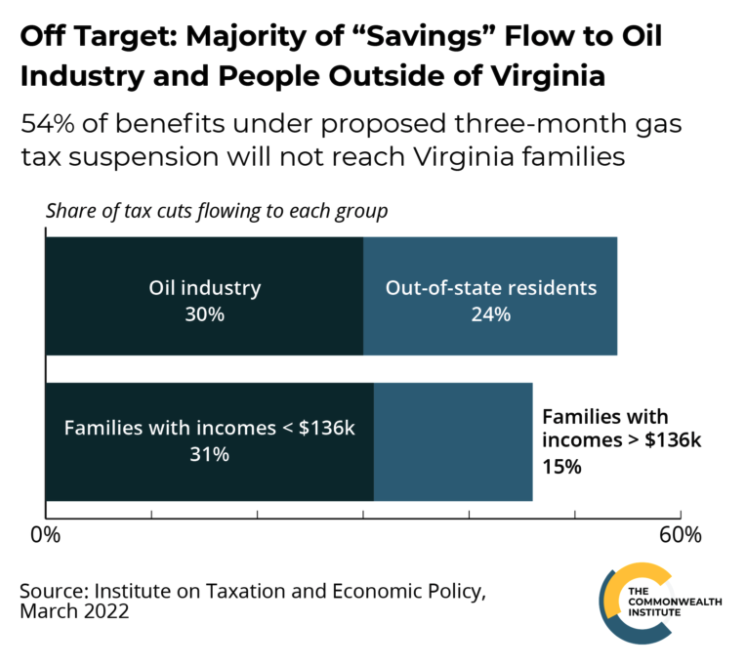

A new analysis of Virginia’s gas tax suspension reinforces the prediction that savings will not go to Virginia residents. The Institute on Taxation and Economic Policy found that 30% of the projected “savings” from this plan would likely flow to oil producers, and another 24% to the trucking industry and out-of-state tourists. Less than a third of the benefit from suspending the state gas tax would actually flow to Virginia residents.

Even if the entire tax cut were passed on to drivers instead of lining the pockets of oil and gas CEOs, it would not add up to much relief. The average Virginian driver buys 50 gallons of gas a month. If all of the savings of the gas tax suspension were passed on to consumers, the average driver would save a maximum of only $13 a month, or $3.03 a week. That’s not much relief compared to the considerable damage caused to our transit and road maintenance operations.

The gas tax helps us help Virginians.

The gas tax is the 2nd largest source of transportation funds for road infrastructure, public transportation, and other services that result in safe, clean, and reliable public transportation. The proposed gas tax suspension would cut transportation funding by over $900 million, including a $106.9 million cut for public transportation, a $32.4 million cut for passenger rail, a $730 million cut for road maintenance and construction, and nearly a $12 million cut for ports!

The past two years have shown that public transit service is essential for Virginians to access their jobs, schooling, healthcare, education, and shopping needs. Virginia has seen a rapid increase in public transportation use thanks to better allocations of transportation funding to transit and rail programs – offering Virginians an affordable, efficient, and clean transportation option. A gas tax suspension would hurt public transit’s development when Virginians need an alternative to gas vehicles.

A gas tax suspension won’t help Virginians save money.

Lower-income Virginians are riding public transportation. The American Public Transportation Association estimates that households pay around $10,000 per year when opting to use personal vehicles over public transit – a cost many Virginia families cannot afford, much less when you factor in rising gas prices. Suspending the gas tax doesn’t help these families – in fact, it takes funding away from the public transportation services that they need and use most.

A gas tax “holiday” hurts drivers too, especially those who can’t afford emergency repairs from potholes and other road damages that damage tires and vehicles. In a Richmond Times-Dispatch Letter to the Editor, a Glen Allen citizen points out how drivers would save more by keeping the gas tax:

“If I buy 20 gallons of gas, with the vehicle I drive it would save me about $5 a fill up. I would rather see the road repaved so it doesn’t cost me $300 to repair my car’s front end after it hits that pothole on Interstate 295.”

Youngkin says that “there’s plenty of money in the system for Virginia to take emergency action without cutting too deeply into transportation funding” – but there are regions in our state that don’t have funding to keep up with basic maintenance needs, much less new projects or improvement projects. A gas tax suspension is just an empty policy – Governor Youngkin tells Virginians he’s putting money back in their pocket, when he’ll just end up getting it out of their wallets another way.

We need a better answer to put money back in Virginians’ pockets.

Instead of suspending the gas tax to the benefit of oil and gas companies and the detriment of low-income families and our drivers, the Governor should provide solutions that actually put money back into the pockets of Virginians. There are other ways to help hurting families without lining the pockets of gas companies. For example, New Zealand provided half-off all public transit fares in lieu of a gas tax suspension to increase access to public transit. In California, working families will receive $400 individual rebate checks in order to not leave behind families that don’t drive.

And for those states that are implementing a gas tax holiday, they’re doing it better than Youngkin’s proposal. Maryland, Georgia, and Florida’s gas tax suspensions will only last one month, and these states have “back-filled” funds for long-delayed and immediate transportation needs. Virginia’s plan cuts much deeper than all these states combined and has no plan to backfill any of the losses. Virginians deserve more than half-baked, ineffective policy from our Governor.

Virginia legislators look to electrify school buses across the state.

Now is the time to transition away from oil and gas.

America will never truly have control of our gas, oil, and energy rates, or our national security, as long as we are dependent on the world oil market. It’s a powerful reminder that fossil fuel dependence is the issue – suspending the gas tax won’t fix this long term problem.

Transitioning away from a fossil-fuel dependent transportation system is the only way we can break free from a volatile market and increasing gas prices. Virginia should look at alternatives to gas vehicles to combat the gas price hike permanently – public transportation, passenger rail, electric vehicles, walking, and biking are all modes of transportation VCN and our Partners advocate for in order to reduce gas demand and the resulting carbon emissions.

For those that need to use a personal vehicle, making the switch to electric is a long-term solution to save money from wild fluctuations in gas prices while reducing our dependence on oil with each vehicle that goes electric. The Clean Cars Standards, supported by VCN and passed in the 2021 General Assembly session, will make electric vehicles more accessible to Virginians by requiring manufacturers to send a certain percentage of EV models to Virginia’s dealerships. While giving Virginians more choice in vehicle purchases in the short-term, this will also add more used electric car options in the years to come. The EV Rebate Program also serves as a tool to make electric vehicles more affordable and speed the transition away from gas – but has remained unfunded by the General Assembly for the second year in a row.

Better yet is to reduce our vehicle miles traveled entirely. Public transit is expanding due to record federal investment, and offers a more affordable, efficient, and cleaner alternative to personal vehicles. Public transit is highly energy efficient, producing some of the lowest per mile emissions of all forms of transportation. A new generation of electric buses are rapidly growing, giving communities a historic opportunity to deliver equitable transportation, cleaner air, and cost savings for transit systems.

Take Action

Tell your legislators to oppose the cuts to the Commonwealth’s passenger rail and public transportation funds as part of the gas tax suspension. See Virginians for High Speed Rail’s action alert to send a pre-written message to your legislators:

Response from the Conservation Community

See statements from our Network Partners below regarding the Governor’s proposed gas tax suspension. Please check back as we continue to receive VCN partner statements.

Last updated March 31st, 2022

Faith Harris

Co-Director of Virginia Interfaith Power & Light

“It is hard to understand how blowing a hole in public transit funding is a good deal for Virginians. Those dollars are critically important to the various transit authorities across the state who desperately need service improvements and expansions. Hindering the ability for increases and improvements in services will create more hardship on families who are currently unable to afford to purchase and the upkeep of a vehicle. Access to robust public transit improves the lives of low-income families. Public transit provides pathways out of poverty through employment, education, cultural events, medical access, and much more. We need policies and laws that will actually improve the lives of Virginians struggling to access vital life services.

For a 12-gallon tank, the 26 cents/gallon savings at the current average of $4.23/gallon will amount to about $3.12 savings. Most of us spend that per day on coffee at our favorite cafe. But, the loss of 26 cents per gallon for three months to the transportation budget will be difficult to cover and will likely cause cuts to service. Those cuts will include zero-fare initiatives, meaning less access for riders. Now is the time for this administration to support increased investment in public transit rather than jeopardizing our transit future.”

Mike Tidwell

Executive Director of CCAN Action Fund

“CCAN Action Fund wholeheartedly opposes Governor Youngkin’s proposed gas tax cuts. The cuts will reduce the available transportation dollars that Virginia desperately needs to maintain the current level of service for public transit, and it will put the Commonwealth out of the running for federal matching grants. Fewer transportation dollars also mean more potholes that never get filled and bridges on the brink of collapse.

Investing in public transit raises the floor for everyone. It’s a surefire way to increase access to jobs, healthcare services, education, and leisure activities for the most vulnerable among us. When more people ride the bus instead of driving their cars, we see cleaner air, increased climate stability, and more connected communities. Subsidizing personal gas-powered vehicle usage is antithetical to creating a more equitable Virginia.”

Stewart Schwartz

Executive Director of Coalition for Smarter Growth

“Putin’s unprovoked war and criminal invasion of the independent, democratic nation of Ukraine has spiked world gas prices. Many Americans agree that big oil companies are now also price gouging and profiteering from the situation. So, the problem with politicians’ proposals to suspend gas taxes begins with the fact that the oil companies will likely claim most of those uncollected funds because prices reset to the world market price.

In addition, suspending the gas tax will mean big cuts in funding for road maintenance, and rail and bus transit, at the expense of all Americans. Less road maintenance means more potholes and more frequent, costly repairs for our cars. It means we’ll fall behind in replacing our crumbling bridges.

Our dependence on oil is a risk to family budgets and to our national security. As a Navy veteran of the Cold War and as a conservationist and smart growth advocate, I urge our elected officials to provide real and lasting solutions to reduce our oil dependency:

- Invest in our cities, towns, and walkable, mixed-use, transit-accessible communities, instead of sprawling development where people have no choice but to drive.

- Invest in clean energy and the charging stations we need for electric vehicles – from buses and intercity rail to electric bikes and scooters to cars and trucks.

- Focus our transportation dollars on rail and bus transit, fast and convenient bike networks, and safer local street networks for all users.

- Invest in affordable housing close to jobs and transit, rather than highways that fuel more sprawl and increase the amount we drive.”

Read the full statement here.

Charles Gerena

Lead Organizer of Drive Electric RVA

“High gas prices are hurting low-income car owners who can’t afford to pay more but can’t cut back on driving either. However, a three-month suspension of the gas tax will yield only minimal benefits while cutting millions of dollars for maintaining the roads and bridges that we all use. Instead, we need to invest in transportation modes that reduce vehicle miles traveled — such as mass transit, biking and walking — and electrify the remaining vehicle miles by making electric vehicles more accessible to consumers, businesses, and government agencies. Not only will this reduce our dependence on expensive fossil fuels that we have to import from politically volatile parts of the world, it will help clean our air and stave off the worst effects of climate change.”

Trip Pollard

Land and Community Program Leader for Southern Environmental Law Center

“Virginians need relief from the rising cost of living, but Governor Youngkin is peddling the wrong cure with his proposals to suspend the gas tax and cap inflation adjustments. These steps offer minimal benefits while cutting revenues for safer, cleaner, more equitable transportation. Experience has shown that oil companies will only pass on a limited portion of a gas tax reduction to consumers and pocket the rest. Yet losing hundreds of millions of dollars of transportation funds will mean fewer road and bridge repairs, as well as cuts to transit and rail service.

Shortchanging our transportation system will harm all Virginians, and people without a car will be hit the hardest. Better steps to reduce transportation expenses include low and no-fare transit, funding alternatives to driving, and offering electric vehicle rebates. Such solutions allow Virginians to save money while supporting energy independence and curbing harmful tailpipe pollution.”

Danny Plaugher

Executive Director at Virginians for High Speed Rail

“The projected reduction in funding to the Commonwealth’s passenger and freight rail program could not come at a worse time. Virginia’s dedicated passenger rail funding places our state in a competitive position to successfully pursue, and secure, more than our fair share of the $66+ billion in competitive federal rail grants.

Before the pandemic, Virginia’s intercity passenger rail trains removed over 545 million passenger miles from our roadways, reduced our fuel consumption by 11.5 million gallons, lowered our CO2 emissions by over 102,000 metric tons, and generated over $718 million in economic benefits.

The Commonwealth is primed to aggressively grow our passenger rail network and service over the coming years, but the elimination and reduction of dedicated funding will greatly hamper the state’s ability to deliver projects on-time or ahead of schedule during a period of continued economic uncertainty.”

Lisa Guthrie

Executive Director of Virginia Transit Association

“From 2018 until the pandemic, Virginia’s transit systems were seeing strong ridership growth as nearly 500,000 transit trips were taken every day in the Commonwealth. Before the pandemic, Virginia’s public transportation systems removed over 1.1 billion passenger miles from our roadways, reduced our fuel consumption by 14.6 million gallons, lowered our CO2 emissions by over 130,000 metric tons, and generated over $4.8 billion in economic benefits.

After two challenging COVID years – transit ridership is starting to bounce back as offices reopen and life begins to return to normal.

However, with increased costs for capital purchases (price of buses has increased over 30 percent), labor, and maintenance (getting new buses on the street now takes about 2 years compared to less than a year before the pandemic, meaning older buses must be used and maintained past their useful life), every dollar invested in public transportation is vital.

Reducing and eliminating dedicated funding for public transportation inhibits our transit systems’ ability to grow to meet increased ridership demands, attract and retain qualified employees, or secure competitive federal grants to build the transit network required to bring the next Amazon or Apple to Virginia.”

Cheri Conca

Conservation Program Coordinator for the Sierra Club Virginia Chapter

“The proposed suspension of Virginia’s gasoline tax purports to give Virginians a break from rising prices. But the effect of a suspension would more accurately apply the brakes to transportation funding for projects such as transit infrastructure, and safety and connectivity of bicycle and pedestrian paths in high-traffic areas. These investments benefit not only owners of fossil fuel vehicles, but also transit riders, EV drivers, walkers and bikers.

Transportation is the biggest source of greenhouse gas emissions in the Commonwealth. Suspending the gas tax would encourage more driving, at a time when it is imperative that we reduce emissions. A tax suspension would not only potentially increase driving, it would discriminate against those who are already doing their part to reduce greenhouse gas emissions: the walkers, bicyclists, transit riders and EV drivers.

Virginia should hit the brakes on the gas tax suspension. It would only create a mild, short-term, inequitable benefit for certain residents while setting up potential long-term ramifications for Virginia’s transportation system.”

Karen W. Forget

Executive Director of Lynnhaven River NOW

“Lynnhaven River NOW stands in opposition to the Governor’s proposed cut in the gas tax in Virginia. Virginia Beach and our neighboring cities and counties in Coastal Virginia are seriously threatened by rapidly increasing sea level rise. For this region to increase its resilience to rising seas and the associated increase in inundation by coastal flooding events, significant roadway and bridge work will be required and the gas tax is a critical source of funding for these projects. Examples of resilience related projects include rerouting and elevating roads, bridge repairs, and reinforcement of infrastructure associated with public transportation. Virginia Beach’s recent bond referendum reflects the high priority of projects designed to help the city shore up critical stormwater infrastructure as sea level rises and storm intensity and frequency dramatically increases. Cutting gas taxes at this time would severely cripple our resilience efforts in coastal Virginia now and into the future.”